Sure, it’s below zero in some parts of the United States right now, but that isn’t stopping some from asking whether the credit crunch is thawing enough to finally benefit financial stocks and exchange traded funds (ETFs).

Here are the signs:

- The Decline of the LIBOR. In mid-October, the three-month LIBOR was as high as 4.8%, says Tom Petruno at the LA Times. Right now, though, the LIBOR is perched at a five and a half year low of 1.09%.

- The TED Spread. It sounds like a condiment, but the TED spread is a measure of the difference between the three-month LIBOR and the three-month U.S. Treasury bill, and the lower the better. It’s currently at a five-month low of 0.98%.

- Companies Raising Cash. Companies have been raising tens of billions in the bond market in the last week. Corporate bond issuance last week totaled $41 billion.

- Mortgage Rates Keep Sliding. The average 30-year home loan rate nationwide was at a record low of 5.01% last week, which has set off a refinancing boom.

Where do we go from here? These are positive signs, and it’s part of what we need to see to begin the march toward economic recovery. This doesn’t mean it’s fixed, though. If it were, banks wouldn’t have their hands out for yet more bailout money.

They’re asking for hundreds of billions more of the TARP funds, and the biggest example is Citigroup (C). It has already received $45 billion, but is still looking to break itself into pieces, report Edmund L. Andrews and Eric Dash for The New York Times.

Federal Reserve Chairman Ben Bernanke seems to be warning President-elect Barack Obama that at least the remaining $350 billion has to go to the banks, if not more, if they’re going to start lending at normal levels again.

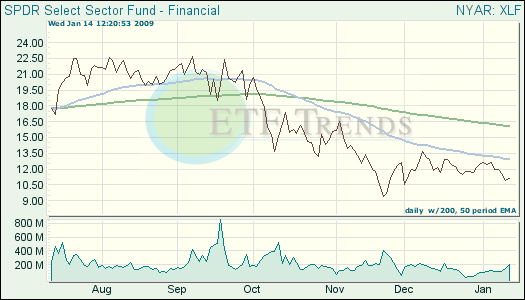

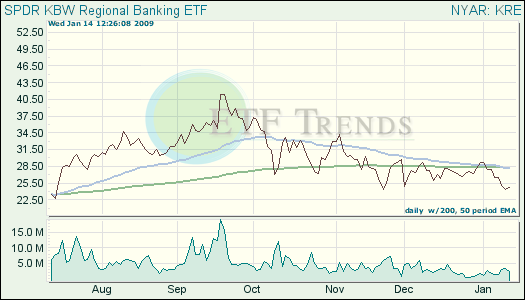

Financial ETFs are off their 50-day moving averages at the moment, but keep in mind that the sectors most beat up in the downturn could present the best opportunities for growth in a recovery.

- Financial Select Sector SPDR (XLF) is down 35.9% in the last three months; Citigroup is 4.3%

- SPDR KBW Regional Bank (KRE) is down 26.5% in the last three months, but up 8.4% in the last six

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.