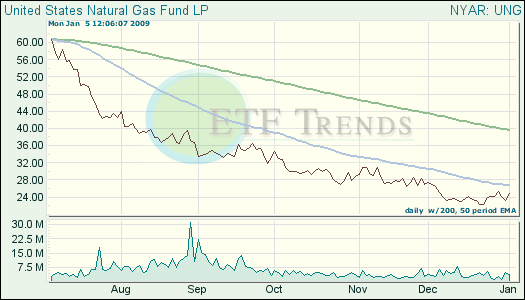

The dispute between Gaza-Israel and troubles between Russia and Ukraine have sent commodities on a rally, giving oil and natural gas exchange traded funds (ETFs) a boost.

Oil prices have pushed $47 per barrel as of Monday, as political unrest continues between Gaza and Israel. Analysts are claiming, however, that there is more behind the push in oil prices than just the disputes. Ukraine and Russia are in disagreement and this has also sent the price of natural gas imports higher, reports Dirk Lammers for the Associated Press.

Demand for oil is expected to remain flat in the coming years and markets may want to move higher in response to the violence. Russian gas monopoly Gazprom has cut off gas shipments to Ukraine since Thursday in a dispute over payments, and Ukraine has warned Europe that natural gas prices may rise as shipments decrease.

Countries in Europe have already experienced a shortage in natural gas as many are dipping into reserves. So far there are not any substantial disruptions in supply but if the dispute between Ukraine and Russia does not dissolve there may be a shortage ahead, reports Maria Danilova for Associated Press.

- United States Natural Gas (UNG): down 25% over three months

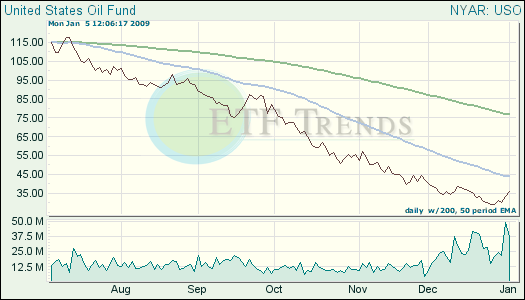

- United States Oil (USO): down 53.01% for three months

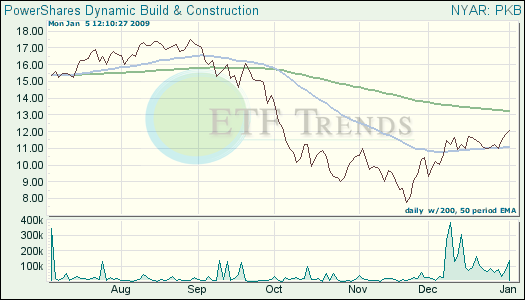

Meanwhile, construction spending fell less than expected in November, spurred by record activity on nonresidential projects, which offset the housing decline. The Commerce Department says spending fell 0.6%, less than half of the 1.3% drop expected, the Associated Press Reports.

- PowerShares Dynamic Building and Construction (PKB): down 4.1% over past three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.