Microsoft (MSFT) is attempting their first round of layoffs, cutting 5% of their workforce, in an effort to rebound their shares and related exchange traded funds(ETF) in the coming year. This is a first for this computer and software powerhouse, proving the economy is affecting all companies – big and small.

Shares plunged 8% for morning trading, and the job cuts came after second quarter reports were lower than expected. A total of 5,000 jobs will be cut over the next year and a half, reports Jessica Mintz for the Associated Press. Other chip-making giants have also cut jobs in an effort to pullback for the slowdown.

In other downbeat technology news:

- Google (GOOG) has had to take off in multiple directions in an effort to keep their large market share. The search engine wants to go beyond the center of the Internet experience and become the center of our lives, reports Intelligent Speculator. By doing more personal searches and also creating an advertising hub for merchants, the search engine has many possible angles.

- Sony Corp. (SNE) is marking its first year of annual loss over a span of 14 years. Efforts to ease the pain include cost cutting, trimming personnel costs up to 30% and early retirement for some in their prized T.V. division, reports Yuri Kageyama for Associated Press.

- Intel Corp. (INTC) is shutting down their Santa Clara, Ca factory, ending an era for Silicon Valley.

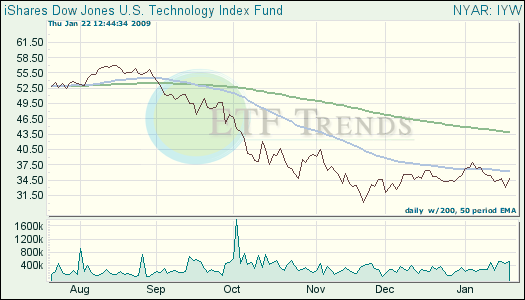

iShares Dow Jones U.S. Technology (IYW): down 9.4% over past three months; MSFT 12.5%, GOOG 5.8%

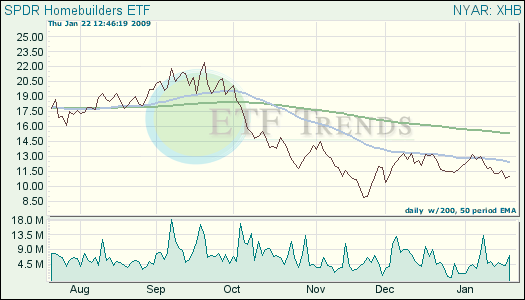

On the home front, U.S. home construction went on a flashback to 1959, ending the worst year yet for new home construction. New home construction fell 15.5% from November to December. The climbing jobless claims are underscoring much of this lethargy, as well.

Jack Healy for The New York Times reports that homebuilders have halted most projects, and home buyers are shy and wait on the side, as home values nosedive and the economy continues to present dire conditions.

- SPDR S&P Homebuilders (XHB): down 22.6% over past three months

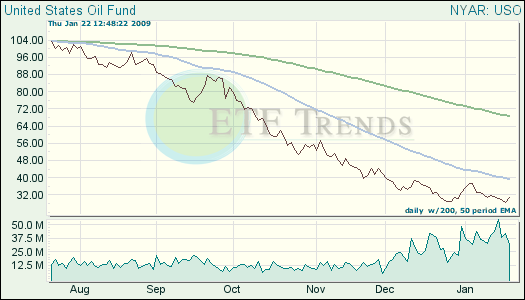

Large stores of gasoline in the United States have sent the crude prices down, proving the economy has come to all but a standstill. Low energy demand, and falling demand from export-driven countries is part of the driver.

Although crude prices are falling, the prices at the pump keep creeping up in response to the lowered demand. Mark Williams for Associated Press reports that light, sweet crude for March delivery had jumped $1.55 to $45.10 a barrel on the New York Mercantile Exchange as positive news from U.S. companies and optimism spurred by Tuesday’s inauguration of President Barack Obama boosted prices. The rally was simply that, and the price of oil fell 6%, or $2.65, to $40.90 a barrel.

- United States Oil (USO): spiked up 8.3% yesterday; down 47.2% over the past three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.