The Standard & Poor’s Case-Shiller 20 City Housing Index fell 18.2% since last November, the largest drop since 2000, giving stocks and exchange traded funds(ETFs) something to worry about.

The closely watched index of home prices fell by a marked amount in November giving way to the lowest housing prices since February 2004. The index recorded year-over-year declines over 23 months. Once the numbers are adjusted for inflation, however, they are not record declines, reports J.W. Elphinstone for the Associated Press.

Cities that have suffered the biggest declines are the ones that were in the biggest bubbles: San Francisco, Phoenix and Las Vegas. The good news is that many families are able to get into the housing market as the prices have declined to more affordable levels.

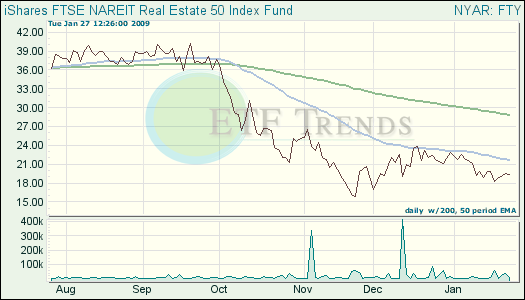

- iShares FTSE NAREIT Real Estate 50 (FTY): down 8.3% over past three months

As a direct result of the glum housing market and the sky-high unemployment rate, consumer confidence fell to a record low in January. The Conference Board, an industry group, said its sentiment index fell to 37.7 from a revised 38.6 in December, reports Pedro Nicolaci da Costa for Associated Press.

Around 13.3% of consumers polled expect the business conditions to get better within the next six months.In January, the expectations index dropped to 43.0 from 44.2 the previous month. Consumers are cleaning up after many years of debt driven spending.

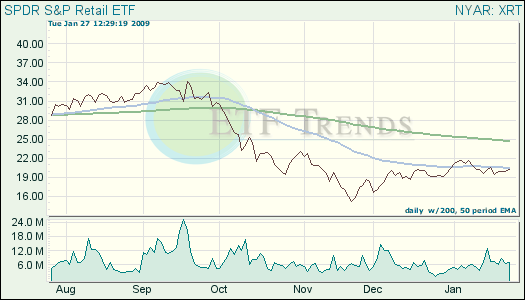

- SPDR S&P Retail (XRT): up 3.8% over past three months

Among earnings:

- Telecommunications company Verizon Communications (VZ) is posting increases of 15% for the fourth quarter, proving that consumers are still reliant on Internet, television and wireless services. The Associated Press reports that the company said it earned $1.24 billion, or 43 cents a share, up from $1.07 billion, or 37 cents a share, a year earlier. Job cuts sliced into share prices at 0.61 cents per share.

- DuPont reports are cutting 2009 forecasts due to the recession and lowered demand from industrial consumers, reports Randall Chase for Associated Press.

The Federal Reserve begins a two-day meeting today, entering into uncharted territory as interest rates are already as low as they can go, reports Neil Irwin for the Washington Post. Tomorrow, they’ll make an announcement at 2:15 ET.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.