At least one options investor is betting that a China-focused exchange traded fund (ETF) will either surge or fall off sharply within the next four weeks.

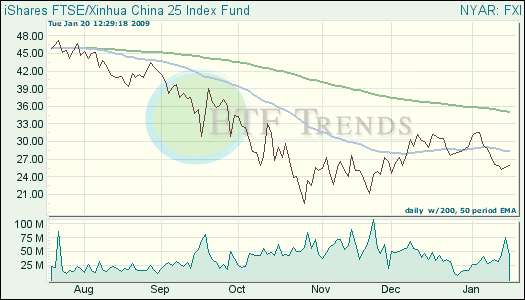

A large straddle appeared to have been bought on the iShares FTSE/Xinhua China 25 Index (FXI), according to one analyst. Doris Frankel for Reuters explains that such a strategy is designed to benefit from any boost in volatility. To be profitable, the ETF’s shares would need to rise as high as $30.60 or fall to $21.40.

The combo strategy is catching the attention of many investors who are wondering where the trade came from, which was a marked size. An option is sold by one party to another which gives the buyer the right to buy (call) or sell (put) a stock at an agreed-upon price, within the certain period or on a certain date. Options in America can be used anytime between the date of purchase and the expiration date.

- iShares FTSE/Xinhua China 25 Index (FXI) is down 10% over past three months

Meanwhile, China has surpassed Germany as the world’s third-largest economy, demonstrating how the global economy has shifted.

In 2007, China’s GDP surpassed Germany’s, with China at 11.9%, and then revised recently again at 13%. China came in at $3.38 trillion, and Germany lagged behind at $3.32 trillion in 2007, reports Ariana Eunjung Cha for The Washington Post.

Du Guodong for China View reports that China’s GDP is going to drop 8.4% this year, from 2008’s 9.1%, but the country will not loose its position as the Eastern region’s hub of growth. The worst case scenario is GDP at 7%. The 2009 target rate is set at 8%.

China has an agenda of goals set that is meant to sustain their economy, with aggressive measures in store for the second half of 2009.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.