After announcing plans to raise $1 billion in five-year notes, it makes one wonder if Walt Disney Co. isn’t struggling. If the entertainment leader is, in fact, then it might not make the leisure and entertainment exchange traded fund (ETF) the happiest place on earth.

Disney (DIS) is among one of the first companies to trek through the bond markets after the federal Reserve slashed the key interest rate to a range between 0-0.25%. This helps cut corporate borrowing costs and pushes Treasury bonds to record lows, reports Deborah Crowe for The LA Business Journal.

Disney’s notes might yield 3.4% more than Treausry bonds of a similar maturity, said one person familiar with the offering.

Disney, which isn’t known for offering deals and discounts, is giving free admission to park-goers if they attend on the actual date of their birthday in 2009. While Disney is diversified across several entertainment areas, no doubt even the parks are hurting as consumers choose to stay home. ABC, which is owned by Disney, is considering job cuts in the first quarter, report Claudia Eller and Richard Verrier for the L.A. Times.

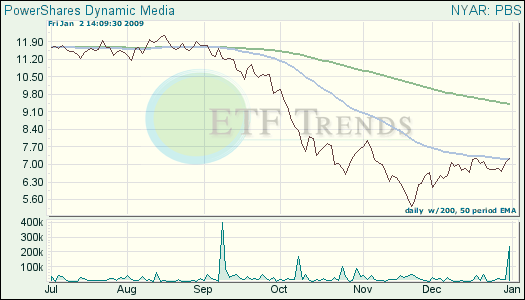

- PowerShares Dynamic Media (PBS): down 49.1% in 2008; Disney 6%

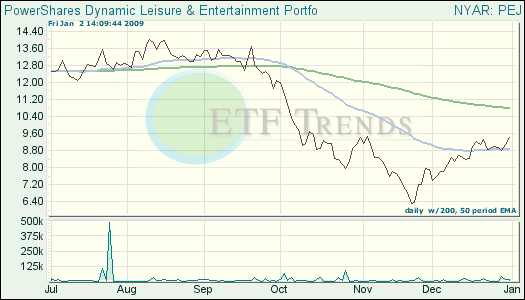

- PowerShares Dynamic Leisure And Entertainment (PEJ): down 39.9% in 2008; Disney 5.5%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.