As an investor, you might know what exchange traded funds (ETFs) are and the many benefits they offer. But do you know what to look for when investing in them?

There are a number of things to consider before diving in when you see an ETF above its trend line.

- Assets. How many assets does the ETF have? A general benchmark to use is somewhere in the $100 million range. The more assets, the more liquidity a fund has. You can find asset information using our ETF Analyzer.

- Trading volume. How high is it? Are people trading it? If no one is trading it, you could have trouble unloading it when it’s time to do so.

- Diversification. Does it diversify your portfolio? For example, if you owned both United States Oil (USO) and Market Vectors Russia (RSX), you could wind up with more exposure to oil than you had intended.

- Diversification, again. Are the ETF’s holdings spread out a little, or are the top three holdings 50% of the fund?

Once you decide a fund has it all: the assets, the trading volume, diversification you’re comfortable with and it’s sitting above its 50-day or 200-day moving average, what’s next?

It’s always wise to have a stop loss in place, even before you get in, because no rally can last forever. Our stop loss is at two key points: 8% off the recent high or when a fund falls below its short- or long-term moving average, whichever comes first.

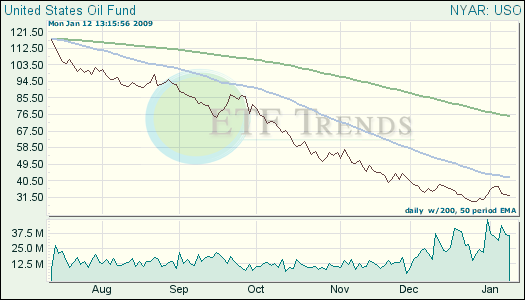

Having a stop loss protects you, as you can see in this chart below:

Oil hit record highs last summer, to the delight of many investors. But the decline since then has been steep. Had you sold when oil fell 8% off the high, you would have protected yourself from the even steeper decline.

USO is nearing its 50-day moving average, and whether it’s this fund or another fund, we could soon see new trends developing that could give investors new opportunities.

Are you ready?

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.