The biotechnology industry and exchange traded funds (ETFs) experienced a renaissance in the first part of the 2000s after the industry was shunned by investors during the 1990s, if the Amex Biotech Index (BTK) is any indication.

Industry’s Trials. The BTK, which was established with a benchmark value of 200 on Oct. 18, 1991, declined by 50% to nearly 100 seven years later, opposing improving industry fundamentals, including record levels of late-stage clinical trials, new product approvals, profitable biotechnology companies, and industry merger and acquisition activity.

According to Michael Becker for Seeking Alpha there are many technical and fundamental pluses that make biotech worthy of investors’ time, however.

- Biotech is a defensive sector that does well in both good and bad economic times (at least under normal circumstances. In 2008, as BTK lost 17.7% in 2008.

- Optimism may rule 2009, as the FDA has been given more money and resources, freeing the agency of many of its constraints. In 2008, new drug approvals were the highest they’d been in three years.

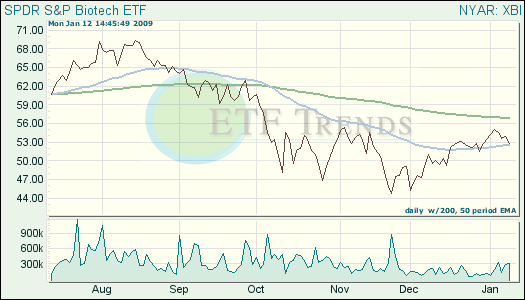

- On a technical note, the Bullish Percent gave biotechnology a bullish indicator for the New Year 2009. This indicator is based on the percentage of stocks in the Nasdaq Biotech Index that are currently trading above their long-term trend lines (the 200-day moving average).

- Mergers and acquisitions are healthy within the sector and may spawn new interest in the biotech sector. U.S. pharmaceutical companies stand to lose billions of revenue from 2010-12 due to patent expirations.

- Momentum will be generated for the industry in the coming years, as upcoming conferences could create attention. For example, more than 300 companies will deliver presentations to thousands of investors next week at J.P. Morgan’s 27th Annual Healthcare Conference held Jan. 12-15, 2009, in San Francisco.

An ETF that represents the industry is the SPDR S&P Biotech (XBI) which is down 14.4% year-to-date; up 3.8% in one month.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.