One of the best performing stock-based exchange traded fund (ETF) segments for the year 2008 was pharmaceuticals, a sub-segment of the health care industry, and there are brighter prospects for the sector in 2009.

In 2009, Damien Conover for Morningstar says that he expects pharma to perform well for a few reasons:

- New drugs could gain traction this year

- Major patent expirations in 2011 have been factored in, for the most part

- There are some blockbuster approvals potentially coming down the pipeline

- More cost-cutting could continue to lift earnings

Gary Gordon of ETF Expert says that the pharmaceutical sector was able to dodge much of the volatility seen throughout the rest of the stock market, and managed to lose only 6%. In comparison, consumer staples took a 16% hit and financials were down by 50%.

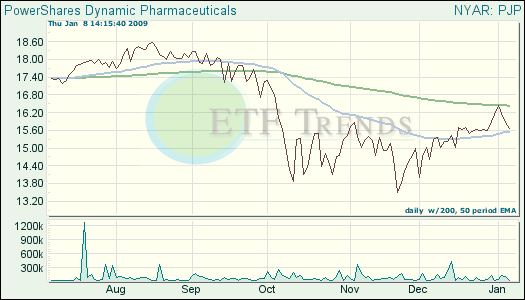

Pharmaceuticals were able to remain stoic through the volatile 3 months and beyond due to the fact that these giants are not only time-tested, they are cash-rich. While pharma appears to be a safe and relatively stable sector there are market trends to watch for before jumping in. Watch the 50 day-moving-average first and get back into the market in increments. By doing so there is less risk and more opportunity to sleep at night.

- iShares Dow Jones U.S. Pharmaceuticals (IHE): down 1.4% over three months

- PowerShares Dynamic Pharmaceuticals (PJP): down 1% over three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.