The steel industry and exchange traded funds (ETFs) were flying high during the building boom in emerging markets. Since the global downturn took hold, though, it’s had many wondering about the outlook for the heavy metal.

Around the globe, raw steel output has dropped 1.2% for the year 2008, signaling a deep and strong downturn that is taking the strength out of one of the toughest industries.

- Falling Demand. The World Steel Association said production of crude steel fell 24.3% year-over-year in December, marking the fourth month in a row for the rapid decline, reports David Goldman for CNN Money. The deep global recession has taken steel demand down while taking industrial production down and durable good orders with them.

- Production Cuts. Since the middle of 2008, steel producers worldwide have been cutting production. In 2008, the U.S. produced 91.5 million metric tons; China produced 502 million; Japan did 118 million. China’s steel sector is big, but lacks strength.

- Crisis Not Over Yet. Analysts believe the global crisis and its impact on China have yet to run their full course, and demand abroad for China’s steel products remains weak, reports Zhu Shaobin for China View. The global financial meltdown has irritated the steel sector in China that is already dealing with excess capacity, low industrial concentration and a lack of access to natural resources.

- Working With What They Have. For the time being, steel producers are simply matching production to demand and avoiding below-cost exports.

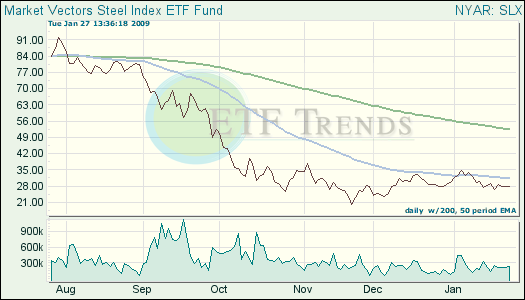

Market Vectors Steel (SLX): up 8.4% over past three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.