The financial sector, more specifically banks, and their exchange traded funds (ETFs) have been beaten, bruised, slaughtered and finally bailed out over this past year and some feel that it is time for a change.

Henry Blodget of Cluster Stock Beta believes that banks need to start with a clean slate immediately, and this is how he thinks they should do it:

- Force the banks to write down all of their assets, not just the ones that are losing value in the present quarter

- Wipe out all stockholders and as many debtholders as possible, acting as if the bank were going bankrupt, leaving just assets on the balance sheet

- Convert taxpayer security into common stock and sell it to the public

Fixing the banks may be what we need to get the credit ball rolling, instill a little consumer confidence and turn the economy around.

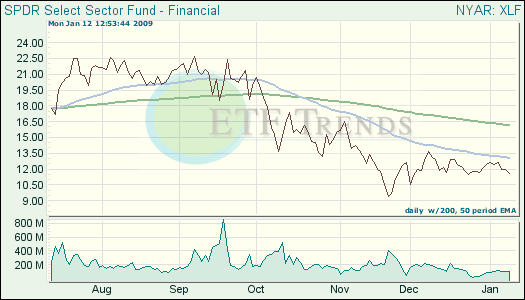

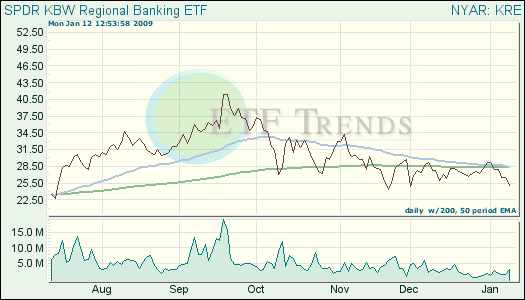

Some ETFs that may be influenced by these recommendations are the Financial Select SPDR ETF (XLF), which was down about 54% in 2008 and SPDR KBW Regional Banking (KRE), which was down about 18.3% in 2008.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.