Real estate and exchange traded funds (ETFs) that track the beleaguered industry have had a rough ride for the past two years. In fact, October alone saw a 5.3% drop in new home sales, while existing homes fell 3.1%.

What’s more the S&P/Case-Shiller home price index shows that home prices have dropped 17.4% on average, and some areas were far worse off than others, reports Ron Rowland for Money And Markets. It is a matter of time before this spreads to commercial real estate as well. Many tenants have already evacuated, leaving offices and storefronts empty.

Rowland emphasizes is that real estate is cyclical: just look at the tech boom, when all that vacant space filled right up. The real estate tide moves very slowly, though, and timing is everything for investors seeking to profit on the industry’s waves.

The average investor found it challenging to get involved with real estate before ETFs came along: buying and selling isn’t always easy, and owning a lot of property can leave one very undiversified. ETFs are a better way to go because it is one of the fastest ways to get real estate exposure with superior liquidity. International real estate ETFs also offer exposure to China, Europe and other developed or emerging nations.

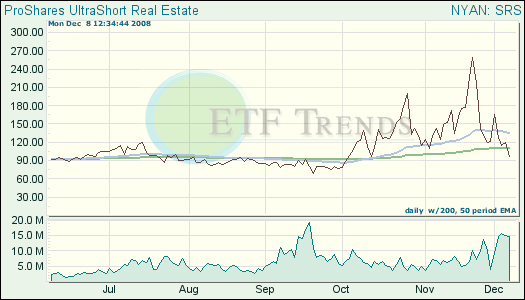

ETFs within this asset class offer transparency, clear pricing, low costs and efficiency/simplicity. And for the down markets there is a short ETF, designed to move up if the markets continue lower.

- iShares Dow Jones U.S. Real Estate (IYR): down 46.5% year-to-date

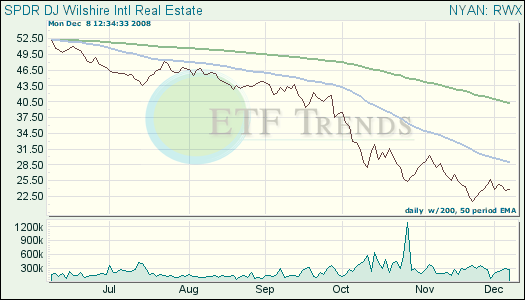

- SPDR Dow Jones Wilshire International (RWX): down 57% year-to-date

- ProShares Ultra Short Real Estate (SRS): down 12.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.