Oil, and the price per barrel, has slipped deeper into the abyss that is the United States recession, taking futures and exchange traded funds (ETFs) with it. Oil prices have dropped to levels not seen in several years, taking the countries that rely on this commodity down for the count.

The geopolitical impact that this is having upon oil-rich countries includes witnessing the revenues come to a halt and seeing their economies crumble, reports Intelligent Investor. Most oil projects are not even able to get to a break-even point, and even as OPEC announced cuts, many other production cuts around the world are being announced.

Scott Jagow talks to Sam Eaton on Marketplace and says that the energy companies have to report the size of their reserves come year-end, and calculate this into an economically reasonable price. This year will not even touch last year’s $96 per barrel close.

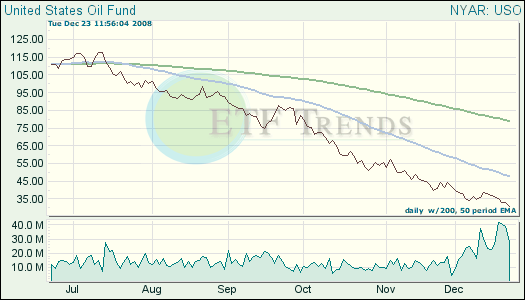

Oil prices can still go down further, but let’s face it: oil will never be free. For investors who can handle the volatility and sudden price movements, oil can be a long-term play with a pre-determined exit strategy and point in place. Also, be sure to have a strategy when you enter the market, too. By watching the 50-day-moving-average and getting back into the market with 25% of your portfolio, the volatility that we will still witness won’t be as painful.

- United States Oil (USO): down 61.7% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.