Whether you’re bullish or bearish, you can’t deny it: commodities and related exchange traded funds (ETFs) have been in the headlines in a major way this year. They’ve also been the center of numerous debates: were they a bubble? Are they done ofr now? Is this just a correction?

Jim Rogers, chairman of Rogers Holdings, feels that commodities will be the place to have your money when the United States comes out of the downturn. Since farmers cannot get loans, they can’t get their fertilizer, and nobody is opening a new mine, leaving supply problems open to shortages, says Rogers.

Eventually, a lack of new supply will lead to shortages again, and since the fundamentals of commodities are still in place, prices will rebound nicely, reports Nigel Stevenson and Brett Foley for Bloomberg. Rogers singles out crude oil and agriculture commodities as the most likely to have shortages.

Rogers has not sold off any commodities since the downturn, and feels that crude oil, cotton, zinc, and agricultural commodities have the biggest opportunity.

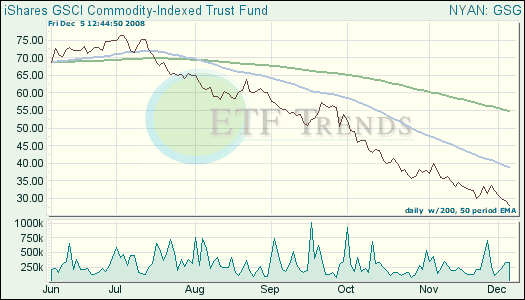

- iShares S&P GSCI Commodity Indexed Trust (GSG): down 47.2% year-to-date; includes commodities weighted by world production; energy, oil, industrial metals, commodities

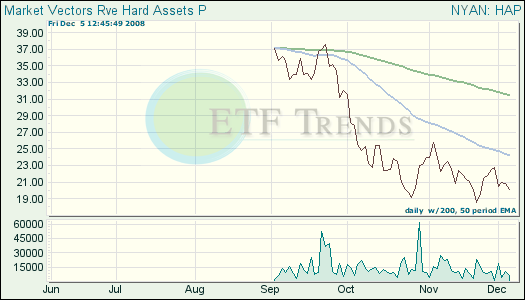

- Market Vectors-RVE Hard Assets Producers (HAP): launched in September 2008

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.