Another rate cut is looming in the near future, as the Federal Reserve kicks off a two-day meeting today to discuss lowering the prime rate to 0.5%, giving gold exchange traded funds (ETFs) a gleaming opportunity.

Any gains the U.S. dollar made may get shadowed by the drive by investors to go to the safe haven of gold, as the rate cut is expected, report Scott Jagow and Ashley Milne-Tyte for Marketplace. Given the circumstances, a rate cut would tend to push the gold prices up.

This historic two-day meeting would include a slash of the key interest rate to nearly 0%, and target special ways to help boost the economy, report Barbara Hagenbaugh and Sue Kirchhoff for USA Today. If the Fed doesn’t push its interest rate target to zero on Tuesday, many economists expect it to do so at its January meeting.

Other options include buying Treasury bonds to push down longer-term interest rates, or stepping up financial support for private consumers and business lenders, according to Federal Reserve Chairman Ben Bernanke.

The Federal Reserve will make its announcement tomorrow at 2:15 ET.

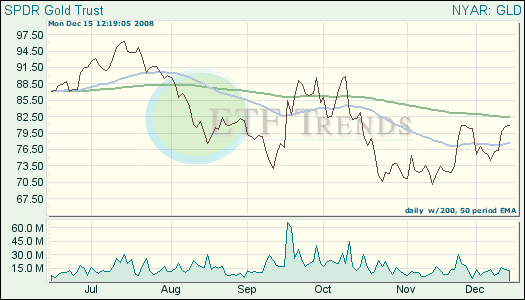

- SPDR Gold Shares (GLD): down 2% year-to-date

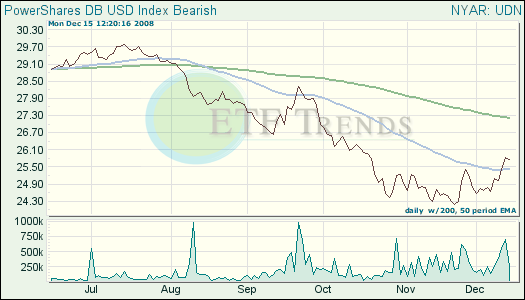

- PowerShares DB U.S. Dollar Index Bearish (UDN): down 6.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.