Southern California Edison is on the cusp of the alternative energy movement, and their push could help warm up solar exchange traded funds (ETFs).

The newest power plant from Edison consists of 33,700 solar panels atop a warehouse in Fontana, CA.

The panels are set to feed green energy directly into the power grid. The swath of photovoltaic panels span two square miles and may be the start of the largest rooftop solar installation in the world, reports Marla Dickerson for LA Times.

When completed, the solar panels would energize more than 160,000 homes. This is the first of more than 150 commercial buildings that Edison is going to outfit with solar panels over the next five years. In comparison, the 250 megawatts roughly equals the capacity of all the solar panels produced manufactured in the entire United States last year.

First Solar (FSLR) is providing the panels. The big push for sola energy that California is making could help this company and solar ETFS, of which it is a major component.

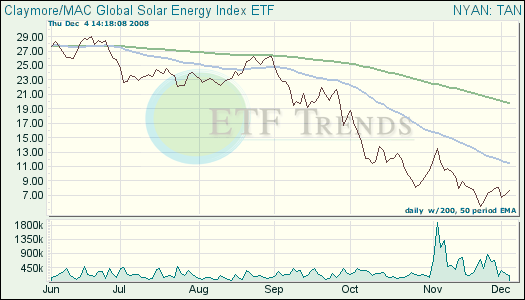

- Claymore/Mac Global Solar Energy (TAN): down 70.3% since its April 15 inception; First Solar is 9.6%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.