President-elect Barack Obama has called for spending billions on infrastructure projects, with hopes of building up some life into the markets and exchange traded funds (ETFs).

The idea is wonderful, however, the execution will be another overhaul altogether, as traditional funding for these types of projects just isn’t there. The usual approach for business will not work in this environment, and the fuel tax that is usually reserved for this type of overhaul does not exist via the government, reports Sam Eaton for MarketPlace.

Patrick Jones says that pricing structure would come from private funding through toll roads. It could reduce wear on roads by encouraging people to drive less, while also prompting more use of public transportation.

Governors met with Obama to secure plans for infrastructure projects this week. The governors are seeking $138 billion for infrastructure projects that are already planned and awaiting funding, reports NewsTimes.com.

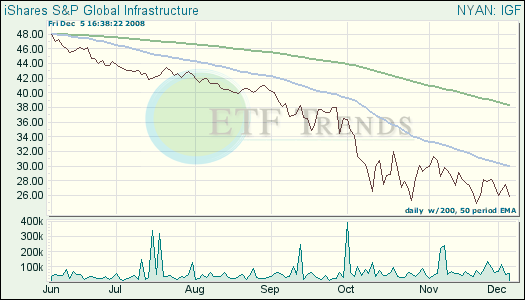

- iShares S&P Global Infrastructure Index (IGF): down 47.2% year-to-date

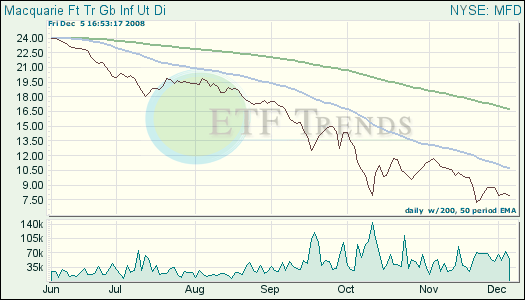

- First Trust Macquarie Global Infrastructure Utility and Dividend (MFD): down 62.3% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.