With the U.S. Senate rejecting a $14 billion bailout of the U.S. automakers, the platinum industry and the exchange traded notes (ETNs) that track the precious metal may find themselves at a crossroad.

Vehicle manufacturers make up about 50% of the total consumption of global platinum and have a direct impact on the demand for the metal.

A combination of the failure of the bailout, the demand for smaller more efficient vehicles, a drought in the sales of vehicles, the 46% decline in platinum prices for the year, and an expected surplus of platinum in the near future has forced the major platinum producers in South Africa to construct cost cutting and efficiency plans to rekindle any losses suffered and plan for a slow future, states Anthony Sguazzin of the Business Report.

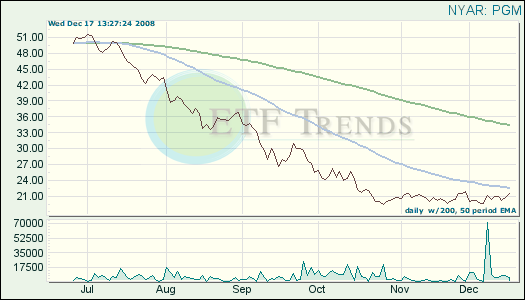

An ETN that may be affected is the iPath DJ AIG Platinum TR Sub-Idx ETN (PGM): down 19.5% since its inception on July 8.

Some experts believe that even with a passing of the U.S. bailout, the platinum industry will not be able to rebound and a major restructuring is needed. They believe that a supply-side adjustment, more specifically, a curb in production is needed to offset the weak demand.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.