Latin American policy-makers and analysts have to try and limit the damage done to their economies and exchange traded funds (ETFs) as the world economy is crumbling and cut their forecasts as more unravels.

Up until September, Latin America thought they had immunity from the world’s economic problems, dodging the worst of the downturn. Now it is apparent that growth is stagnating and commodities, which fueled the success, are not so hot. The Economist states that the worst part of this is that banks are now cautious in Latin America and credit lines are hard to come by.

Latin American economies are now pondering whether they should inject capital into their economies like the United States and Australia have done, and if so, can they afford it?

The only answer is “maybe” as the scope for governments safely to spend their way back to higher growth is also limited. Falling tax revenues, weaker currencies and low reserve funds are keeping the liquidity to a minimum. The World Bank’s chief economist thinks the best answer is to maintain current levels of spending while the tax revenues keep dropping.

Another helpful step taken in Latin America, particularly Brazil, is the education of its workforce. Making an investment in the future and building up workers’ skills could pay dividends in the future.

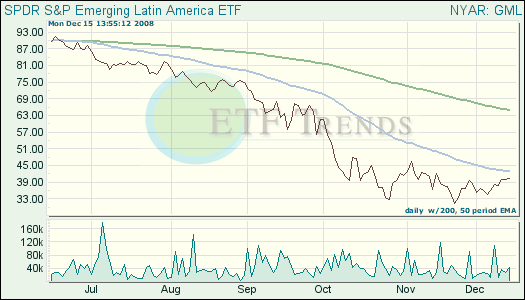

- SPDR S&P Emerging Latin America (GML): down 51.4% year-to-date; Brazil is 59.3%; Mexico is 24.7%; Chile is 9.2% and Peru is 3%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.