Treasuries, and the bond exchange traded funds (ETFs) that represent them, are trotting into “overvalued territory,” and the danger lies in falling yields.

The investor demand for Treasuries may be near the “bubble” phase, as witnessed by tech in 2000 and housing in 2006, reports Wes Goodman for Bloomberg. David Rosenberg for Merrill Lynch says that the 10-year note is at the 3% threshold and the next step down will represent a classic mania-to-bubble phase. There is even a possibility of overshooting the April 1954 lows of 2.3%, says Daniel Kruger for Bloomberg.

Yields on two-, 10- and 30-year debt have dropped to levels that haven’t een seen since the U.S. began regular sales of the securities. Yesterday, the yield on the two-year was 0.9%; on the 10-year, it was 2.74% and the 30-year was 3.23%.

The biggest threat is that the yields will continue to fall and remain at record lows, even if the Treasuries reside in overvalued territory, as investors remain on the hunt for quality.

Treasuries have been especially alluring this year as the market has seen turmoil that hasn’t been experienced in decades.

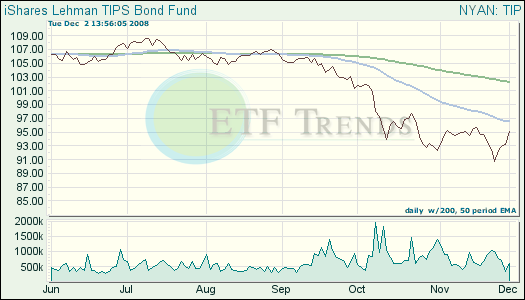

- iShares Lehman TIPS Bond (TIP): down 6.6% year-to-date; the yield is 7.83%

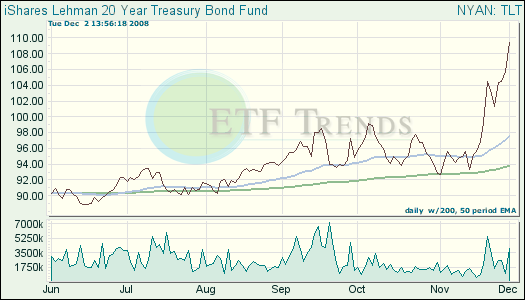

- iShares Lehman 20+Year Treasury Bond (TLT): up 22.3% year-to-date; the yield is 3.93%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.