The “R” word doesn’t have to be a bad thing, in fact, this can be a very prosperous time for those who prefer not to pay retail, either for their goods or exchange traded funds (ETFs).

Eventually, the wreckage that is the stock market will one day rebound, and the financial chaos that has everyone reeling will stop. However, the stock market will have to recover before any of the economy even starts to, and it could be a while. Gene Walden for Star Tribune reports that a normal recession lasts about 11-12 months, but this time around is nothing normal or average, so it may be a while before any new growth shows.

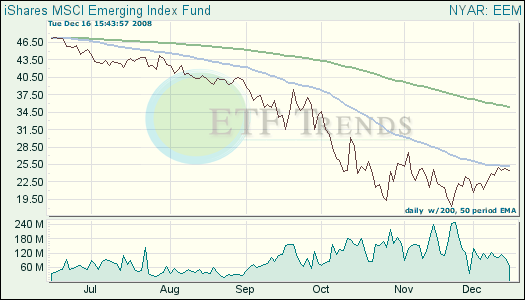

When that opportunity presents itself, you should be ready with a plan, some sort of investment strategy before entering the market. One area that could be considered is asset allocation, and this should take into account the timeline. That is, how far off is your target retirement date? This will determine your risk appetite. Emerging markets and small-cap international stocks are other areas that you may consider to get proper diversification, reports Andrew Tanzer for Kiplinger’s Personal Finance.

Some of the most beaten-down areas of the market could come back the strongest in a turnaround. They include:

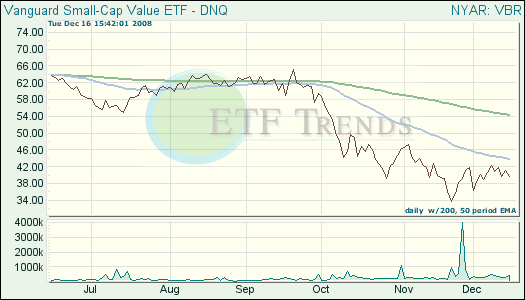

- Vanguard Small-Cap Value VIPERs (VBR): down 31.9% year-to-date

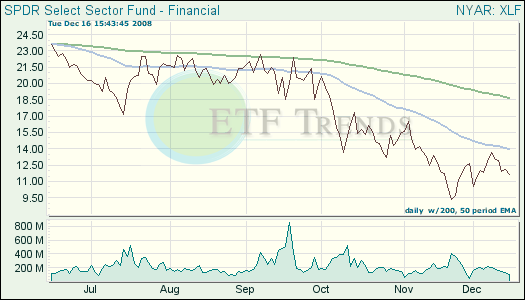

- SPDR S&P Financial (XLF): down 47.5% year-to-date

- iShares MSCI Emerging Markets Index (EEM): down 42.7% year-to-date

But no matter how great the bargain, make sure that you’re sticking to your strategy. Following market trends and watching the moving average for ETFs is crucial. Our strategy is that once a fund has crossed its 50 day-moving-average, then put in 25% of the value of your total portfolio. After the fund goes up another 5%, then put another 25% in. By this time the 200-day moving average should be in sight.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.