The recent rate cut by the Federal Reserve has had the intended effect in some areas, by setting off a buying spree for investors, sending them in search of bond exchange traded funds (ETFs) with higher yields.

This has been evidenced in heavy buying of exchange traded corporate bond funds, says Tom Petruno for The LA Times. Some have even been venturing into the junk bond sector.

Yields on junk securities remain sky-high, but have pulled back a bit as the bonds’ prices have rallied, while Treasury bond yields continue to slide. The question now with junk bonds is whether it’s investors looking to lock in yields, or speculators chasing short-term momentum.

Other yield-hunting investors have also been going after municipal bonds, since historically the yields are high and they’re tax-free, unlike the corporates.

The central bank also said it might buy Treasuries for its own portfolio, to keep downward pressure on longer-term interest rates.

Either way, while the temptation for these yields is alluring for an investor, be strict with a discipline and watch the market trends.

- iShares iBoxx $ High Yield Corporate Bond (HYG): down 18.7% year-to-date; 12.03% yield

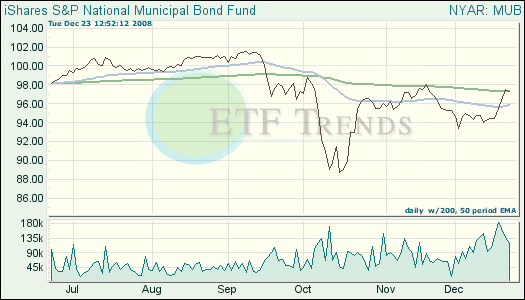

- iShares S&P National Muni Bond Fund (MUB): down 1.2% year-to-date; 3.6% yield; 6.12% tax equivalent yield

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.