Over-exposure to domestic markets and exchange traded funds (ETFs) may be detrimental during times such as these.

On average, American investors have anywhere from 2%-20% exposure in foreign markets. This can prove dangerous for a few reasons.

Tim Hanson for The Motley Fool says that this leaves you too vulnerable to the slowing in the United States’ economy. Declining home values, a weaker dollar and a beat up portfolio are not a good mix.

Second, when you ignore foreign markets, you’re all but assuring that you are going to miss out on the greatest economic growth forecast to come in the next 10 to 15 years. From a growth standpoint, China, India, Brazil and even Vietnam and Mexico have more potential going forward.

While growth has slowed or even reversed course in most markets in the world, domestic and global, this won’t always be the case. Valuations on emerging markets may be looking ripe in the near future.

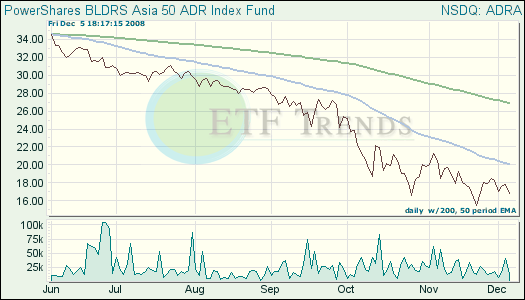

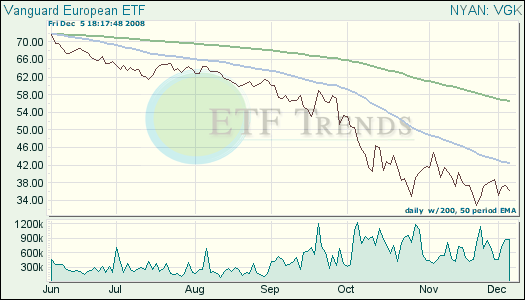

Foreign markets have been beat up along with everyone else. Some might take longer to recover, while others may bounce back nicely. Be sure to have a strategy in place before jumping back into the market. The 50-day moving average is a good place to start, and moving incrementally instead of all at once will give you more control.

- PowerShares BLDRS Asia 50 ADR Index Fund (ADRA): down 51.3% year-to-date

- Vanguard European (VGK): down 49.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.