Congress and the White House are on the brink of an agreement for a deal to help the failing autoworkers, however, Democrats must act quickly and specifically in order to salvage this industry and any related exchange traded funds (ETFs).

So far, a basic outline is in place for a bailout plan, but the details need to be worked through with a fine-toothed comb. A vote will be finalized on Tuesday, reports the Associated Press. The main objective of the bailout is that automakers show a detailed plan of how they will claim responsibility in the future.

Investors on Wall Street seem excited about Obama’s bailout plan, taking the Dow Jones Industrial Average up 300 points, while awaiting the fate of Detroit. Joe Del Bruno for the Associated Press reports that Obama’s weekend announcement of the plan involves the U.S. public works spending program, working on infrastructure, and ultimately putting our nation back into employment. Meanwhile, the $15 billion bailout is also anticipated, and investors are giddy during this time.

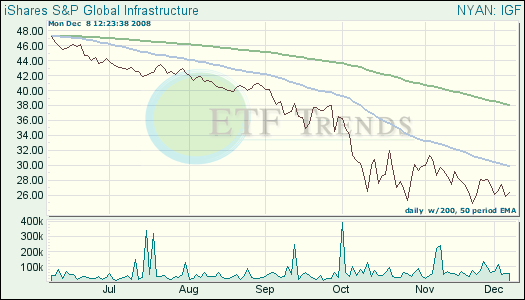

iShares S&P Global Infrastructure (IGF) could use the boost, as it’s down 47.2% year-to-date.

Any instant recovery should not be expected, Obama has said, and the economy may worsen before it gets better. He stated that things are not going to simply turn around, but that he will get things moving once he has taken oath, reports David Espo for the Associated Press.

Meanwhile, a more unnerving word is emerging in the national conversation about our economy: “deflation.” At first glance, it doesn’t seem so bad: it means prices are falling and demnd is dropping, and consumers are relieved, says Gail Marks-Jarvis for the Chicago Tribune.

But the trend eventually feeds on itself: prices fall because the economy has slowed; businesses then try to attract customers by offering lower prices; as the prices fall, businesses become more pinched as debts mount; those businesses then start to scale back by laying people off; as layoffs continue, consumers cut back more out of fear…and so on.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.