Germany has serious issues to attend to with their gloomy economy and their markets and exchange traded funds (ETFs) prove this. Germany’s central bank has said the economy, Europe’s largest, is on track for a contraction of 0.8% in 2009.

But lawmakers are at work to find ways to combat the looming troubles. German Chancellor Angela Merkel is facing much criticism on her decision to reject tax cuts and take other action. There is the possibility, however, of another proposal from economist Karl Lauterbach, reports BusinessWeek. His proposal is along the same lines of the United States’ and the “Bush Money” stimulus checks.

In an effort to boost domestic demand, the parliament would issue a $633 check to every adult to spend as needed. The voucher would be valid only if the user kicked in $253 of their own, however, welfare recipients would be free of this stipulation.

There has been no party agreement on this proposal and the idea would cost the state $44 billion to $57 billion, financed through debt. Anther plan to remodel public buildings is also taking shape.

In response, the governor of one major party is criticizing the proposal because it sways citizens not to spend their own money this close to Christmas. Politicians are also being called upon to take action in an effort to float Germany’s ailing auto industry. Much of this is sounding all-too-familiar, as the economic downturn has infected many countries and industries.

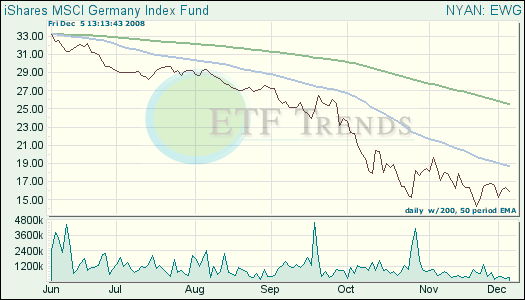

- iShares MSCI Germany Index (EWG): down 51.8% year-to-date

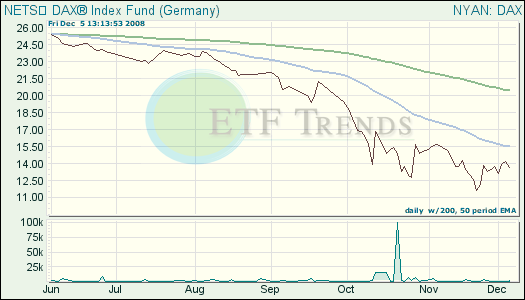

- NETS DAX Index (DAX): down 511% since inception

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.