India’s economy slowed to an annual rate of 7.6% in the quarter ending Sept. 30, hardly bringing good news to exchange traded funds (ETFs) focused on the emerging country. On the other hand, the US would love to have a positive GDP growth number…

The attacks in Mumbai, India’s commercial mecca, aren’t going to take an immediate toll on their economy and growth. The government’s response to the tragedy will determine the long-term impact. If the government takes steps to reassure the nation and institute measures to deal with future incidents, the long-term impact on the economy should be minimal, reports Jackie Range for The Wall Street Journal.

The growth for the third quarter 2008 until the first quarter of 2009 are expected to take the biggest hit, with the next four quarters dipping around 6-7%.

India’s central bank is working to boost liquidity in the financial system and cut interest rates.

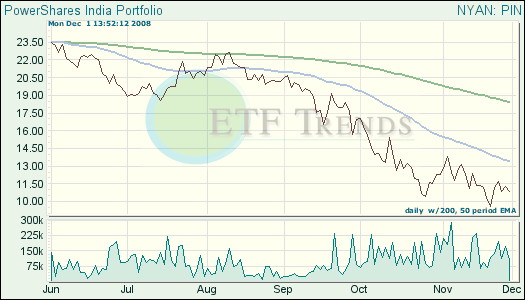

- PowerShares India (PIN), down 57.6% since March 5 inception

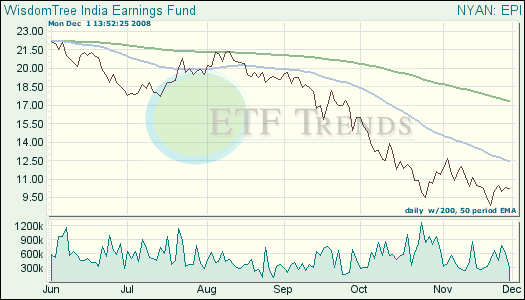

- WisdomTree India Earnings (EPI), down 61% since Feb. 26 inception

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.