The aches and pains of the economy we feel in the United States are also felt throughout the world, both within their markets and exchange traded funds(ETFs).

The World Bank has warned that the world is about to enter into a rare global recession, and there is no place to run and hide. World trade is expected to fall next year for the first time since 1982, while capital flows to developing countries is estimated to plunge 50%, reports Mark Landler for The New York Times.

World Bank officials think that if the forecasts and the numbers are accurate, developing nations will be thrown into a crisis, and tens of million of people will be at poverty level. With all countries suffering, there is “no engine to drive a recovery.”

What does this mean for ETF investors? If these numbers prove to be true, you’re not hopeless. It’s never too late to have an exit strategy. There are safe places to put your cash right now. And always be prepared for a rebound, too.

- SPDR Dow Jones Wilshire Total Market (TMW): down 38.2% year-to-date

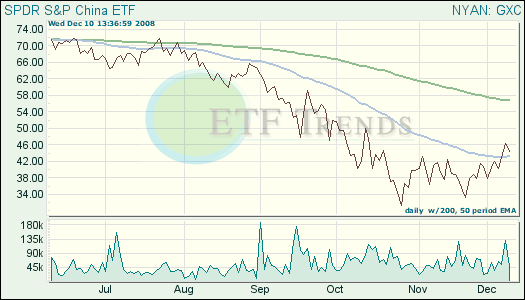

Chinese imports have dropped dramatically. The U.S. consumer is not spending as they usually would, and China is not about the pick up the slack. The drop in China’s import/export numbers is the lowest since April 1999, when their economy was till staggering from the 1993 recession, reports Reuters.

China is the world’s fourth-largest economy, and other Asian countries have fallen as the slowdown has begun to creep around the globe. Both South Korea and Taiwan had a drop in shipments last month.

- SPDR S&P China (GXC): down 50.4% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.