An annual rebalancing of the Russell/Nomura Japanese stock indexes just wrapped up with a 30% turnover rate for the value and growth components, impacting related exchange traded funds (ETFs).

Index Universe repports that the Russell/Nomura Total Value Index had 212 deletions and 176 additions, while the Russell/Nomura Total Growth Index had 270 deletions and 136 additions. This was among the highest Russell rebalancing for an index since their 1981 inception.

Companies deleted from the indexes were removed primarily because of a large declines in their market capitalizations. These aren’t the only indexes that have seen shifts, either. Citigroup (C) was deleted from a few indexes last week.

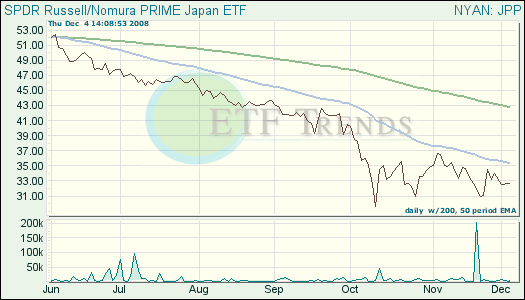

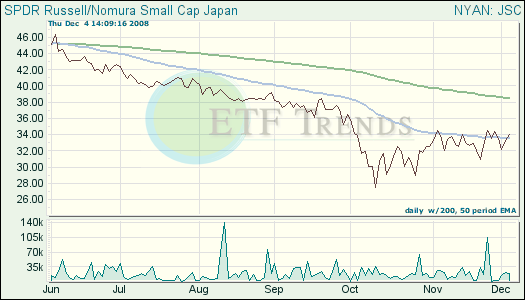

Japan has been a lucrative country for investors, as many funds that track Japan have relatively held up in performance, while other developed international market funds have slid. They haven’t been exempt in the downturn, though.

- SPDR Russell/Nomura PRIME Japan ETF (JPP): down 35.2% year-to-date; 1000 float-adjusted stocks

- SPDR Russell/Nomura Small Cap Japan (JSC): down 27.1% year-to-date; 1100 companies

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.