The Japanese government is getting active in their rescue plan to help salvage markets and exchange traded funds (ETFs). Their new stimulus plan is aimed at a $255 billion injection to get their economy up and running again.

This second package is being implemented after a previous plan in October, which did not help resuscitate the financial markets. On Friday, the Japanese yen surged to its highest level against the U.S. dollar in 13 years, sending stocks plunging and hitting the country’s exporters, reports BBC News.

A weaker yen could help the economy in the long run, as it would reignite exports. Right now, the strong yen is tamping down demand.

Among industrial nations, Japan’s goal is not only to recover from the global recession, but to be the first ones to do so. The new stimulus package also includes tax breaks and public financing projects worth millions of dollars. Japan’s economy is the world’s largest after the United States’, and it shrank at a rate of 1.8% annually in the third quarter.

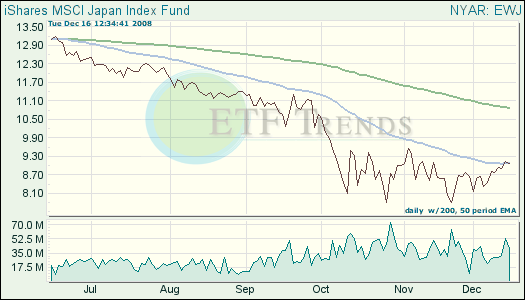

- iShares MSCI Japan Index (EWJ): down 26.4% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.