Until recently, there was strength in the U.S. Dollar Index and the exchange traded fund (ETF) that goes bullish on the index. But there’s a long-term price structure overlaying the current price movements.

While the dollar enjoyed a bump from 1995 to 2001, the index is actually on a long-term downtrend despite the big move recently, says Corey Rosenbloom for Daily Markets. The price last peaked in 2001, then there was an attempt to swing up again in 2002 and 2006, and now we’re up to recent events.

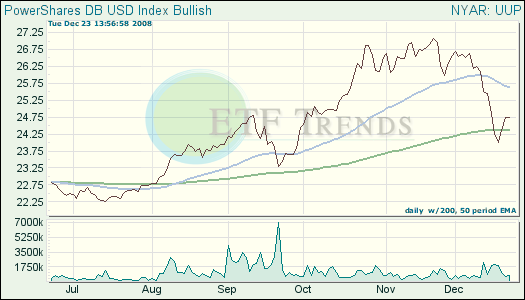

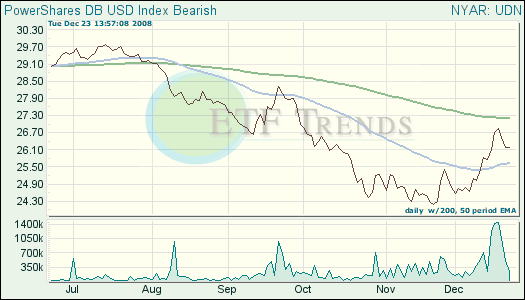

That brings us to the question: are we in wave four of an uptrend in the middle of a larger downtrend? It’s interesting to note. For decisions regarding where to invest, we look at the 200-day moving average (and in the short-term, the 50-day) to determine where to be in and when to stay out.

Rosenbloom points out that a weak dollar isn’t necessarily uniformly a bad thing. It gives an assist to multinational corporations like McDonald’s (MCD) and Caterpillar (CAT). It also helps commodity-based companies and commodity prices. It makes the United States a more attractive place to visit, since tourists can stretch their money further.

However, the weak dollar hurts small companies and causes Americans to scale back on their travel to other countries.

Two ways to track the dollar through ETFs are:

- PowerShares DB U.S. Dollar Index Bullish (UUP): up 5.1% year-to-date

- PowerShares DB U.S. Dollar Index Bearish (UDN): down 4.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.