A surge of new unemployment claims and the growing threat of deflation have slapped down upon the government, giving markets and exchange traded funds (ETFs) another huge hurdle to overcome.

As of Thursday, initial applications for jobless benefits for the week of Dec. 6 rose to 573,000, up from 515,000, which is higher than the 550,000 Wall Street estimate, reports Christopher S. Rugaber for the Associated Press.

These numbers, along with a rising trade deficit is making the recession seem bottomless, and where we will end up is still unknown. The U.S. trade deficit rose to new highs in October and our trade deficit with China is up as well. Martin Crutsinger for the Associated Press reports that the Commerce Department reported Thursday that the trade deficit rose to $57.2 billion October, 1.1% higher than the September imbalance of $56.6 billion.

There are persistent fears that the painful recession is going to get worse, and next year will unravel many problems, compounding others. Rising unemployment, weak home prices, low stock prices, finance firms and debt-ridden businesses will all suffer and take down the goods and services area of the economy, reports Jim Christie for Reuters.

Deflation, rather than inflation, is the newest threat, where falling prices would cut demand and sway employers from hiring. While low prices might seem like a good thing on the surface, it creates a vicious cycle that can be hard to escape.

The foreclosure process just got a makeover, making the process painstakingly longer. Foreclosure activity actually dropped to June levels and will now rebound in January. The January foreclosure spike will be re-enforced by the unemployment numbers, as increased foreclosure activity follows lay offs, says one analyst.

In the U.S. around 259,000 homes were in foreclosure in November, down 7% from October, but remains 28% higher than one year ago, reports Alan Zibel for Associated Press.

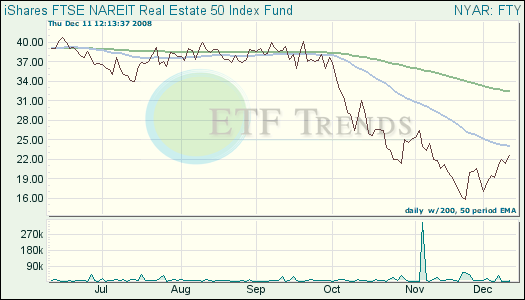

- iShares FTSE/NAREIT Real Estate 50 (FTY): down 40.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.