With the increasing worries of global warming, cleaner energy and ways to make it more cost-efficient is the talk of the town and ultimately could help benefit the exchange traded funds (ETFs) and stocks that follow the sector.

Until recently, ethanol used in transportation fuel had been moved by trucks or trains, resulting in high costs in getting ethanol to the market and an increase in carbon emissions in the production and use of ethanol.

Kinder Morgan (KMP) just announced that it has started production of the only U.S. ethanol pipeline made to transport ethanol. Once completed, this will increase cost efficiency in transporing ethanol. The only problem is that by the time the pipeline is completed, there may not be a sufficient supply of ethanol to shove through, states Paul Ausick of 24/7 Wall Street.

However, if this pipeline is successful, and costs are lowered, then perhaps a domino effect may hit the commodities market resulting in a price rally.

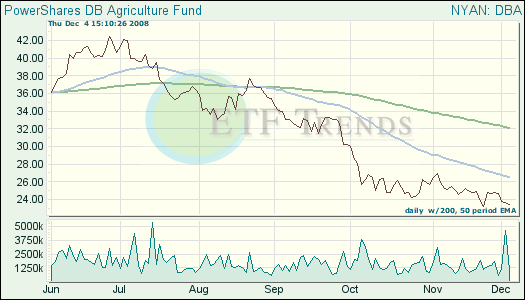

Just look at PowerShares DB Agriculture Fund (DBA), which is down 29% year-to-date. With the continous push for cleaner energy by the Europeans, the United States and Japan, the demand for this infrastructure and technology will continue.

PowerShares Global Clean Energy Portfolio (PBD): down 66% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.