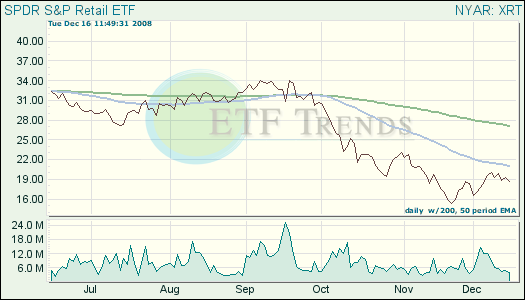

While consumer prices are falling at the fastest rate on record, it doesn’t seem to be delivering an equal boost to retail exchange traded funds (ETFs).

While some of the larger retail funds are up slightly in the last month, it’s hardly reflective of the rapid drop in prices, which hasn’t been seen since the government began keeping track in 1947. At cash registers and gas pumps, prices were 1.7% lower in November from the month before, reports Jack Healy for the New York Times.

It’s a shift from earlier this year, when economists were decrying rapid inflation. Now it’s deflation that’s got them worried, and with good reason, too. It creates a vicious circle that can be difficult to escape once it’s in motion. Regardless of lower prices, consumers still seem nervous and reluctant to open their wallets. A never-ending stream of deals and promotions seems to be having little effect.

- SPDR S&P Retail (XRT): down 44.5% year-to-date; up 0.9% in the last month

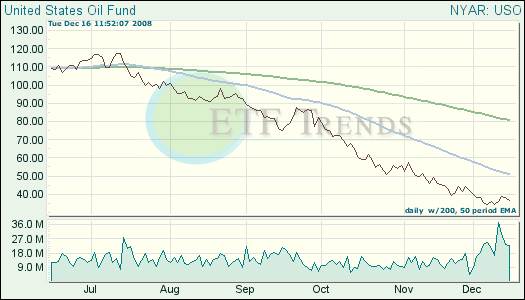

Oil prices, meanwhile, have been on an uptrend over the last few days. OPEC is expected to meet tomorrow to announce a huge production cut, aimed at keeping prices from falling further, reports Pablo Gorondi for the Associated Press. The cut could be by as much as 2 million barrels per day. OPEC’s president feels that a fair price for oil is in the neighborhood of $70 to $80 a barrel. Otherwise, OPEC says, they lose money on production.

- United States Oil (USO): down 51.4% year-to-date; 68.6% below its July 14 high

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.