You are viewing an older ETF Trends article from 2008. You may be interested in reading our more current articles on Commodity ETFs and Frontier Markets.

The United Arab Emirates has watched from a distance as the global credit crunch has unraveled in the West, but they didn’t imagine it would hit home in both their markets and exchange traded funds (ETFs).

The price of oil is the livelihood of these nations, and the recent 70% drop in the oil prices have begun to lead to a crumbling of both the economy and the real estate market, reports Stanley Reed for BusinessWeek. According to industry sources in oil-poor Dubai, some home prices have dropped 20%-30%, while other developments are seeing declines of up to 50%.

Real estate prices are crumbling for villas and apartments, along with sales, and investment banks are drying up, cutting jobs and pulling back. Some of these bankers have put their futures in the possibility of Dubai becoming a major financial center.

Throughout the Gulf, the stock exchanges have crashed, credit is gone and the Sovereign Wealth Fund, initially set up for use when oil reserves have dried up, have seen huge losses. Analysts are suspecting that problems in Dubai are only mounting and it could be very expensive in the long run. Bankers and executives are trying to work out the rescue of Dubai and figure out how it will be paid for.

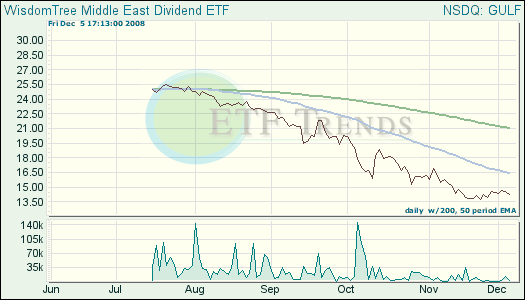

- WisdomTree Middle East Dividend Fund (GULF): down 43.2% since July 22 inception

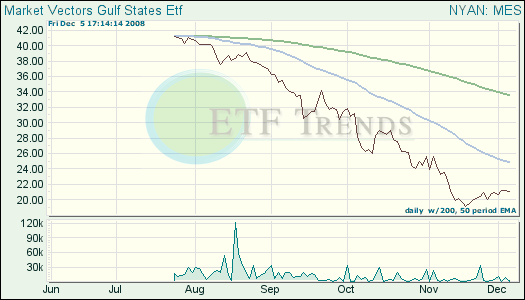

- Market Vectors Gulf States (MES): down 46.2% since Aug. 21 inception

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.