How can infrastructure lead the U.S. economy toward a recovery, when the global malaise upon is and emerging markets, investments and exchange traded funds(ETFs) are down in the dumps?

Carl Delfeld for ETF XRAY says that infrastructure as an investment theme presents two trends: urbanization and infrastructure gap in emerging markets and nations. As the world has grown and certain cities have urbanized or industrialized, the stronger economic growth and international trade has led the way for more need for infrastructure.

Areas that need building up in certain industrializing nations are seaports, airports, roads, railways and pipelines. Here, in the United States, infrastructure is aging and in need of repair and upgrades for efficiency and safety. An investment in this sector will lead to more job creation and more capital flow, helping to pull the United States, and perhaps even the rest of the globe, out of a recession.

Points that Delfeld has regarding global infrastructure:

- 5% of Brazil’s roads are paved

- Canada is launching a $33 billion infrastructure plan

- China is building 97 regional airports by 2020; they spend 10% of GDP on infrastructure a year

- Container terminals have seen 42% growth in three years

- South Africa’s mobile phone companies are growing 4% a year

- Mexico City’s population will soon surpass 20 million

ETFs to consider:

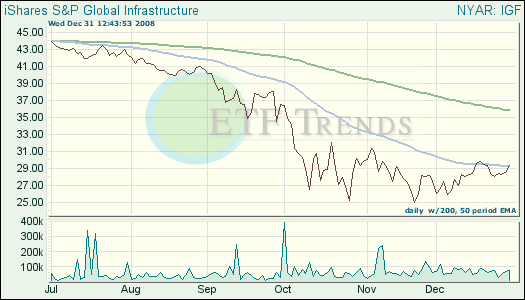

- iShares S&P Global Infrastructure Index (IGF): down 43% year-to-date

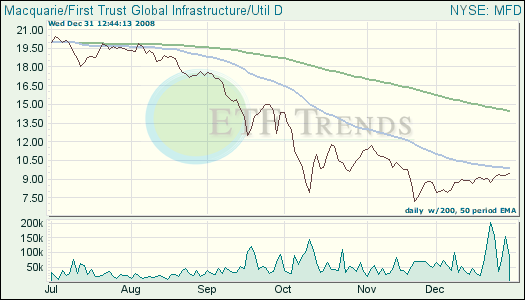

- First Trust/ Macquaerie Global Infrastructure Utility and Dividend Index (MFD): down 57% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.