Did the Taxpayer Relief Act of 1997 play a significant role in the bursting of the U.S. housing bubble and the struggles of the exchange traded funds (ETFs) that track the sector?

A provision in the act gave investments in real estate a more tax preferential treatment than any other investment option. More specifically, it exempted the first $500,000 (for married taxpayers) and $250,000 (for single taxpayers) of gain from any home sales from capital gains taxes. Of course there are some stipulations, such as that a homeowner has to live in the residency for at least two out of five years before selling.

As a result, it made buying real estate a more common investment tool, making it something in addition to just a means of putting a roof over one’s head, states Vikas Bajaj and David Leonhardt for The New York Times.

The net effect of this act was that it made real estate a tax-free investment and inflated the real estate market. At the end of the day, its role was still not as influential as other factors:

-

loose lending standards

-

a failure by regulators to intervene

-

a sharp decline in interest rates

-

a collective belief that real estate prices could never decline

Some ETFs that may have been influenced are:

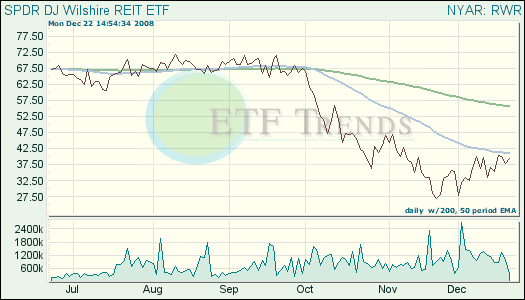

- SPDR DJ Wilshire REIT (RWR): down 43.4% year-to-date

- iShares Dow Jones U.S. Home Construction Index (ITB): down 47% year-to-date.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.