The emerging markets exchange traded funds (ETFs) are described as excellent diversification tools, with the potential for risk and volatility, as they should be used with caution.

That’s been especially true this year, as emerging markets have been among the hardest-hit of the global markets. Unfortunately, volatility is often an afterthought in the good times, says Elizabeth Ody for Kiplinger. Recent months illustrate that even though potential for growth is there in these countries, the volatility factor is important.

Ody lists five reasons why those volatility warnings are there in the first place and what it means for your investments later:

- This is what they mean by volatility. Now that the markets are upside-down, how have emerging markets fared in comparison to the broad U.S. stock market? In 2008, volatility has shot up across the board, even in ho-hum muni bonds. But at least relative to the United States, volatility in emerging markets has been modest.

- Emerging markets were once thought to be uncorrelated to the United States and other developed nations. This was re-iterated by emerging-markets stocks sporting higher price-earnings ratios than stocks in developed markets toward the end of the bull run in 2007. As it turns out, these markets are more correlated to America than once thought.

- Leveraged and overseas money is not easy to pick through, so it is hard to tell what money came from where. Some of the undoing is from leveraged investors, but how much is hard to say.

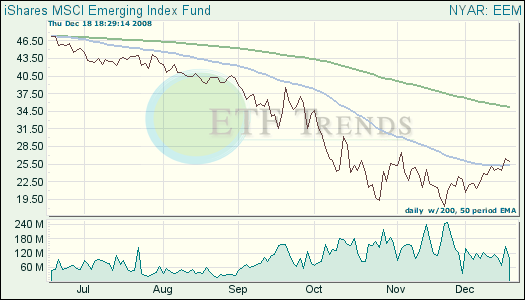

- Having an investment strategy should be high on every investor’s list, and also considering asset allocation before going in is important. By using a simple method such as the 200 day-moving-average, and by observing market trends, there is less chance of huge unforeseen losses. Have a plan, and use it.

- If you do have a strategy, pulling out of the market and taking bigger losses wont be a problem. If a fund drops below the 200 day-moving average, or drops 8% off its high, it’s time to get out while you can.

- iShares MSCI Emerging Market (EEM): down 49.4% year-to-date

For full disclosure, some of Tom Lydon’s clients own shares of EEM.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.