Panasonic Corp. has offered to acquire Sanyo for $9 billion, a move that could charge Japan’s exchange traded fund (ETF), among others, and make the company a leader in the rechargeable battery market.

The offer, however, is for less than market price and is being considered positively by Goldman Sachs, says Hiroshi Suzuki for Bloomberg.

The acquisition would nearly quadruple Panasonic’s share of the rechargeable battery market, as well as give it access to Sanyo’s solar-cell technology. Sanyo is the world’s seventh-largest producer of such technology. A merger between the two could create a force in both technology and solar-cell development.

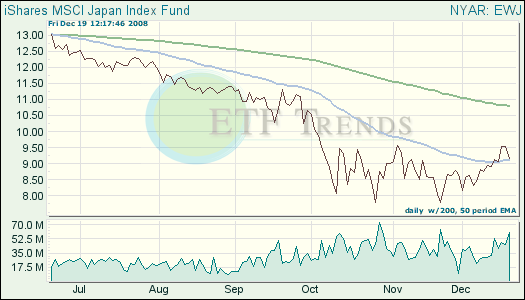

Both Sanyo and Panasonic are small components of the iShares MSCI Japan (EWJ), which is down 30.6% year-to-date. Panasonic is 1.5%; Sanyo is 0.1%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.