Retail sales in Mexico are flatlining, as the numbers fell for the second straight month since October, giving investors and exchange traded funds (ETFs) a reason to feel edgy.

Just as in the United States, consumers in Mexico are not buying household items such as appliances or clothes, and the service sector is giving out along the way and has slowed substantially. The bloodline for the Mexican economy is the service sector, which makes up around 60%.

Jason Lange for Reuters reports that the economy in Mexico was already hit hard becuase of the collapse of the U.S. housing market and tighter credit blunting American consumers’ appetites for Mexican factory wares.

Alongside this slowdown is the fact that oil-consuming Mexico is facing a shortage of this commodity. Oil exports will run out in less than seven years at current decline rates, and the urgency to reverse the sharp fall has created a flurry of activity in Mexico’s oil patch.

If Mexico can reverse the trend of the low-level investment in the source, output will stabilize or at least fall at a slower rate over the next few years. This would guarantee fiscal revenue at home and a stable source of U.S. oil imports when demand picks up again, says Peter Millard for Dow Jones Newswires in Mexico City.

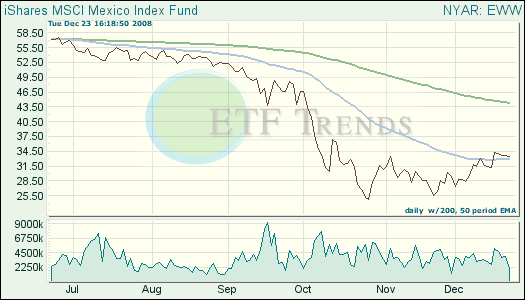

- iShares MSCI Mexico Investable Market Index (EWW): down 41% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.