As the U.S. real estate market is in shambles, Chinese real estate may be building up, upgrading exchange traded funds (ETFs) as they go.

The Chinese residential market has managed to maintain its strength, and the pace of construction is hard to keep up with. Tony Sagami for Money and Markets illustrates this with the fact that around 70% of all the world’s construction cranes are on Chinese soil.

According to the National Development and Reform Commission, China’s top economic planning agency, house prices in 70 large- and medium-sized Chinese cities rose 9.2% in the second quarter from a year before. Around 80% of all Chinese homes are bought with 100% cash, and the savings rate in the country is 25%. This is why China’s housing market has been isolated from the U.S. breakdown.

There are a couple Chinese real estate stocks and ETFs listed on U.S. exchanges that could eventually reflect the buildup in Chinese real estate:

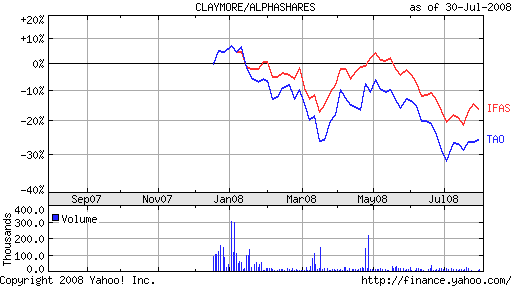

- Claymore AlphaShares China Real Estate (TAO), down 29.6% year-to-date

- iShares FTSE/EPRA NAREIT Asia Index Fund (IFAS), down 21.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.