Amidst the U.K. budget deficit ballooning to its widest since 1946 and a jump in inflation, UK exchange traded funds (ETFs) are feeling the repercussions.

Bank of England policy makers are “struck” by the recent jump in inflation, which risks stoking price expectations. These policy makers are fighting the U.K.’s worst battle against inflation in more than a decade, all while trying to steer the economy clear of a recession.

Svenja O’Donnell and Brian Swint for Bloomberg report that policy maker Andrew Sentance as saying, “It’s not clear that the slowdown in the economy that has emerged so far is significantly sharper than we were projecting in the May inflation report . We may have to accept that the economy slows further, that we’ve got a few more difficult quarters in the real economy” in order to bring inflation down to the central bank’s 2% target.

Sentance acknowledged that inflation is rising in the short term, and that getting on top of it is paramount.

With faster price increases and the worst housing market slump since the U.K.’s last recession, economic growth is expected to slow well into 2009. Economic growth is expected to slow to a 1% annual pace in the 2009 first quarter, according to the Bank of England in its May 14 inflation report. The U.K.’s budget deficit is now at its widest since 1946, report Mark Deen and Gonzalo Vina for Bloomberg.

Funds that cover this area and could be affected are:

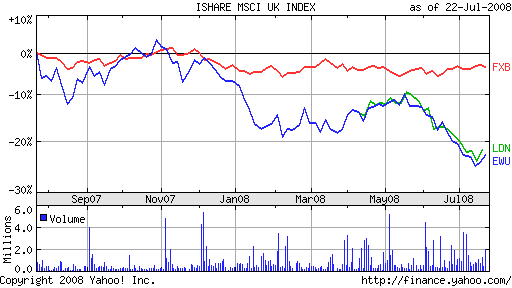

- NETS FTSE 100 Index (LDN), launched on April 4

- iShares MSCI United Kingdom Index (EWU), down 12% year-to-date

- CurrencyShares British Pound Sterling Trust (FXB), down 2.5% year-to-date

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.