JP Morgan Chase upgraded Turkey’s rating from underweight to neutral, which is welcome news for its related exchange traded funds (ETFs).

No reason was given for the change, but it might imply the adding of Turkish bonds to the trading portfolio of its Emerging Market Bond Index Global Index (EMBIG), which is a widely followed benchmark of those markets, reports Selcuk Gokoluk for Reuters.

JP Morgan sees an 80% possibility of a “market friendly” verdict regarding the survival of the AK Party, the future of which has been in question for awhile. The verdict is expected by the end of the week.

If the party is shut down, JP Morgan feels the political stability will be restored relatively quickly.

Gwynne Dyer for the Scotsman writes that Goldman Sachs has a new set of forecasts about the developing economies of the world. One of the predictions is that Turkey’s economy will be bigger than those of Japan, France and Italy by 2050.

A couple funds give access to this area:

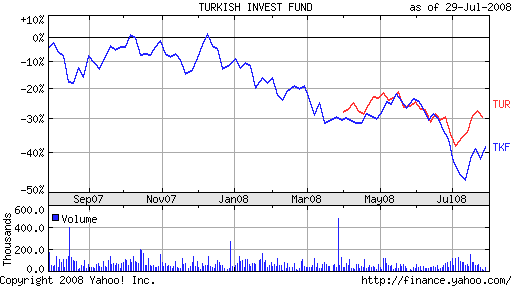

- iShares MSCI Turkey (TUR): Up 3.4% since April 1 incpetion

- Turkish Investment Fund (TKF): A closed-end fund (CEF), which is down 31.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.