It’s a sign of the times: Toyota is ceasing production of gas-guzzlers and ramping it up for the in-demand hybrids, which could help exchange traded funds (ETFs) that hold shares of the automaker.

Auto sales in the United States have lagged on record gas prices, and consumers are particularly wary of shelling out for pickups and SUVs. In response, Toyota (TM) says it’s going to produce the Prius here, reports Dee-Ann Durbin for the Associated Press.

Prius sales fell 34% in June, but not for the resasons you’d think. The fuel-efficient car is so popular that Toyota hasn’t been able to keep up with demand. Often, they sit on the lot for just four or five days before they’re sold. By contrast, the Toyota Tundra pickup sits on the lot an average of 64 days before selling.

Toyota is a top component in the following ETFs:

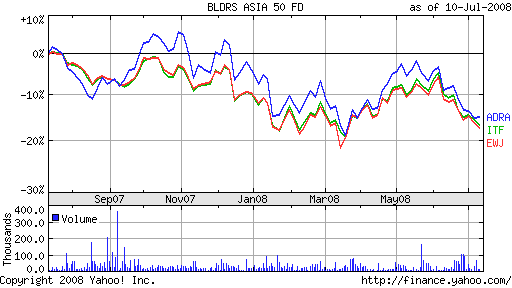

- iShares MSCI Japan (EWJ): down 8.1% year-to-date; Toyota is 5.1%

- BLDRS Asia 50 ADR Index (ADRA): down 11.3% year-to-date; Toyota is 10.6%

- iShares S&P/TOPIX 150 Index (ITF): down 6.7% year-to-date; Toyota is 6.2%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.