As the United States is trudging through an economic downturn, coupled with sky-high oil prices, there is a country and its exchange traded fund (ETF) that is reaping the rewards of energy prices.

However, the boom times are feared by some to be turning to bust. Russia has an economy that is heavily fueled by oil and gas, and now it might be running too hot, reports the Associated Press.

The abundant natural resources has sent the economy’s growth up 7% a year for the past decade. Real disposable income has doubled during the past five years and is growing at a 10% rate every year. Suddenly, many Russians are able to buy cars, reports The Economist. Car ownership is still very low, at 200 for every 1,000 people, a low correlation for developed nations. For 2007, sales of new cars have grown 36% by volume, and 57% by value, thanks to the increasing buying power of the Russian consumer.

But now Finance Minister Alexei Kudrin says the country’s gross domestic product (GDP) is growing at too fast a clip, and any stimulus measure will lead to “intolerable” inflation and bring growth to a halt.

Record oil prices have kept the dollars flowing in, and the country’s rising middle class is going on a spending spree as bank loans are becoming increasingly accessible. Forbes now lists more billionaires in Russia than in New York.

If oil prices continue their recent retreat, what will it mean for the Russian economy?

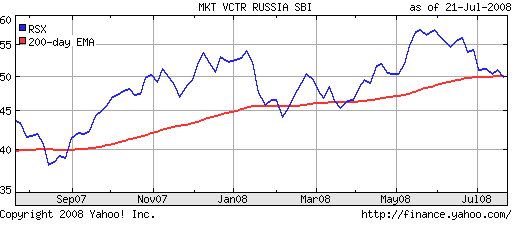

The Market Vectors Russia (RSX) is heavily weighted in the energy sector, which makes up 42.6% of the fund. Another 26.5% is in industrial materials. It had a strong start earlier this year, but year-to-date, it’s down 1.8%. It’s 0.1% above its trend line.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.