Retail sales and related exchange traded funds (ETFs) took a hit today as the June numbers came in.

The 0.1% increase was weaker than analysts had expected, mostly because auto sales have plunged, reports Martin Crutsinger for the Associated Press. The 4.6% jump in sales at gas stations wasn’t enough to offset the 3.3% spill in sales at auto dealerships. Had it not been for auto industry weakness, retail sales would have posted a 0.8% jump.

Meanwhile, gas and food prices contributed to the sharpest increase in the wholesale inflation in 27 years, Crutsinger says. Prices for June jumped 1.8%, and over the last 12 months wholesale prices are up 9.2%. It’s the largest year-over-year surge since AC/DC released For Those About to Rock, We Salute You (that’s 1981).

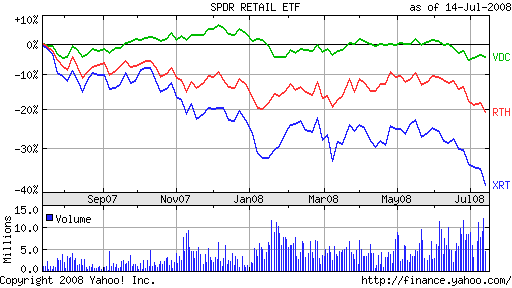

Retail ETFs are mostly up slightly today, but have a ways to go before they can erase this year’s losses. And while consumers might be spending more on gas and food, they’re hardly going on frivolous shopping benders:

- SPDR S&P Retail (XRT), down 18.3% year-to-date

- Retail HOLDRs (RTH), down 8.4% year-to-date

- Vanguard Consumer Staples (VDC), down 7.1% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.