Oil exchange traded funds (ETFs) are spilling today as prices plummeted by as much as $9.26 a barrel.

The price plunge was the hardest in 17 years, reports Adam Schreck for the Associated Press. It lost $6.44 and settled at $138.74 a barrel. At one point, it was down more than $10.

Concerns about falling demand was the catalyst, reports Kenneth Musante for CNNMoney. Federal Reserve Chairman Ben Bernanke said today in his testimony that high prices are sapping the purchasing power of households in the United States.

President Bush also called for more drilling on both coasts, plus Alaska, to combat oil prices. Meanwhile, the Organization of Petroleum Exporting Countries lowered its demand forecast for 2008 to an increase of 1.2% from 1.28%.

But supply is threatened by Brazilian oil worker strikes at offshore rigs operated by Petrobras, which are now in their second day. Petrobras says two rigs have been totally shut down and that production is off by 4%.

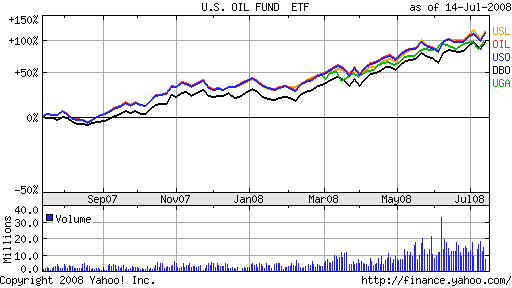

Oil and gas ETFs are trading sharply lower today, including:

- United States Oil (USO), up 55.1% year-to-date

- iPath S&P GSCI Crude Oil Total Return Index (OIL), up 54.6% year-to-date

- United States Gasoline (UGA), up 33.2% since Feb. 28 inception

- PowerShares DB Oil (DBO), up 58.5% year-to-date

- United States 12 Month Oil Fund (USL), up 60.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.