Aside from individual issues, investors can gain access to high-yield bonds through exchange traded funds (ETFs), traditional mutual funds and closed-end funds (CEFs).

Dealing with individual issues of high-yield bonds is often difficult because of issuer and liquidity risk, which makes some sort of fund the most common choice.

Roger Nusbaum for TheStreet theorizes that because of the nature of ETFs, they would be a less volatile method of entering the high-yield market than most closed-end funds. With closed-end funds having a set amount of shares, the market price can drift from the net asset value. This can result in closed-end funds falling more than expected in times of extreme change in the market. On the contrary, ETFs can create or redeem shares based on demand, which allows for the market price to stay closer to the net asset value.

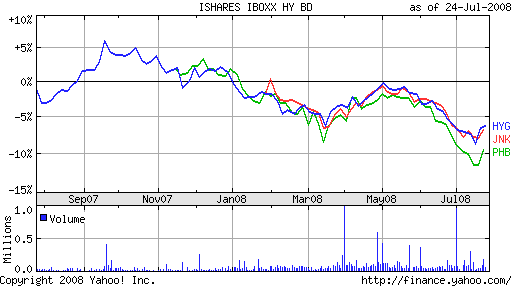

With market volatility and amid turmoil, high-yield ETFs fared well relative to closed-end funds. ETFs such as the iShares iBoxx $ High Yield Corporate Bond Fund (HYG) have proved that they can withstand bear markets by practically sitting out the panic that occurred in mid-March. However, it will be interesting come the next bull market or economic expansion to see how ETFs and closed-end funds compare.

Some high-yield bond ETFs include:

- iShares iBoxx $ High Yield Corporate Bond Fund (HYG), down 3.1% year-to-date

- SPDR Lehman High Yield Bond (JNK), down 5.3% year-to-date

- PowerShares High Yield Corporate Bond (PHB), down 6.9% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.