China’s stocks and exchange traded funds (ETFs) are up by the most in nearly three weeks, led by banking shares.

Two of the country’s largest banks – Merchants Bank and Citic Bank – reported that their first-half earnings had more than doubled, report Zhang Shidong and Chua Kong Ho for Bloomberg. Beijing North Star Co. also rose on speculation that next month’s Olympic Games will lure more tourists to the city. They’re expecting 1.5 million visitors.

Air China Ltd. was benefiting on optimism about adding more flights to Taiwan. The 60-year ban has officially ended as a Chinese tourist flight took visitors to the country, a lift-off that is anticipated to boost the economies of both countries and their ETFS.

The significance for the airline and the country is enormous, and China and Taiwan have agreed to start direct flights for tourists, symbolizing a reunification between the two governments, reports Eugene Tang and Tim Culpan for Bloomberg.

ETFs that may feel the winds of change:

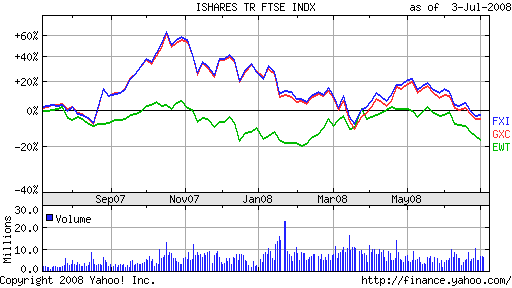

- iShares FTSE/Xinhua China 25 Index (FXI): down 25.3% year-to-date; Merchants Bank is 3.7%; Citic Bank is 1%; Air China is 0.4%.

- SPDR S&P China (GXC): down 27.9% year-to-date; Merchants Bank is 1.7%

- iShares MSCI Taiwan (EWT): down 7.9% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.