Glug, glug, glug. That’s the sound of Pepsi’s second-quarter profit rising, which has bubbled up the food and beverage exchange traded fund (ETF).

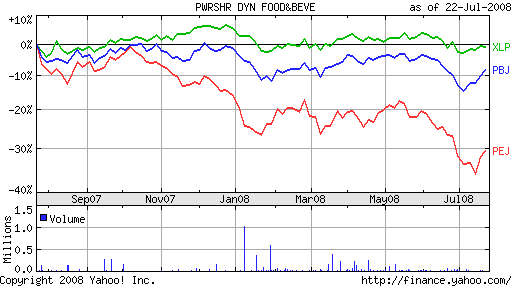

PepsiCo (PEP) reported a 9% jump in profits in the most recent quarter, thanks to strong international sales and a weak U.S. dollar, reports Vinnee Tong for the Associated Press. The company is 4.6% of PowerShares Dynamic Food & Beverage (PBJ), which is down 5.7% year-to-date. Pepsi isn’t just a purveyor of beverages: the company also has a robust snacking business, including Cheetos, Ruffles and SunChips.

McDonald’s (MCD), which is 5.2% of PBJ, also reported higher profits because of strong international sales. Low-priced menu items also became more attractive to customers who are strapped for cash.

Other ETFs that could be affected include:

- Consumer Staples Select Sector SPDR (XLP): down 5.2% year-to-date; Pepsi is 4.3%

- PowerShares Dynamic Leisure & Entertainment (PEJ): down 20% year-to-date; McDonald’s is 5.4%

There’s no shock here, but ConocoPhillips (COP) reported that its second-quarter profits soared, thanks to the price of oil and gas, reports John Porretto for the Associated Press. Revenue last year was $47.4 billion. This year, it shot up 50.6% to $71.4 billion.

Oil prices are continuing to trade lower today, to $127.44 by early afternoon, reports Adam Schreck for the Associated Press. Gas prices are dropping, too, with the national average now at $4.042 a gallon.

Conoco is a major holding in:

- Energy Select Sector SPDR (XLE): down 3.1% year-to-date; Conoco is 8.4%

- Vanguard Energy (VDE): up 0.2% year-to-date; Conoco is 7.4%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.