Microcap exchange traded funds (ETFs) might hold the smallest of small companies, but they can also be capable of big things.

The Russell microcap index is actually an index made up of businesses so small, you may not have heard of a majority of them. But Gary Gordon for ETF Expert points out that once the U.S. economy reaches its lowest point and businesses begin to show signs of growth, the smallest businesses may be the ones to grow the most.

In an economic recovery, smaller companies tend to perform best because they’re nimble and quicker to act when the market conditions are favorable.

iShares Russell MicroCap Index Fund (IWC) is one such ETF that puts all these businesses in one easy-access basket.

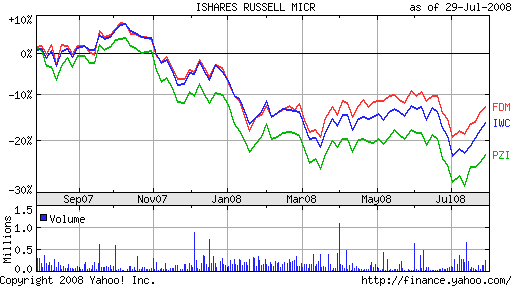

Although business cycles of the past have shown that microcaps are an indication of what lies ahead in the near future, investors may want to wait for another sign of recovery within the technical realm. IWC has yet to actually lead the S&P 500. Also, IWC ralied after the summer 2007 subprime scare, then did a nosedive, and then went up with the news of the Bear Stearns bailout, only to bottom out for the June and July summer heat.

Gordon feels that once the recession is half way through, we may not feel a recovery coming on, but IWC has been equally treading water, possibly acting as a sign that small businesses may have good things ins tore for them soon. The fund is down 10.9% year-to-date.

Other microcaps to keep on the radar once the economy shows strength:

- First Trust Dow Jones Select Micro Cap Index Fund (FDM), down 6.7% year-to-date

- PowerShares Zacks Micro Cap Portfolio (PZI), down 13.4% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.